Gold price development: ten major influencing factors

Gold facts & figures 15.05.2020

Learn how the gold price reacts to interest rate changes, inflation, industrial innovation, stock indices, central bank decisions, and crises.

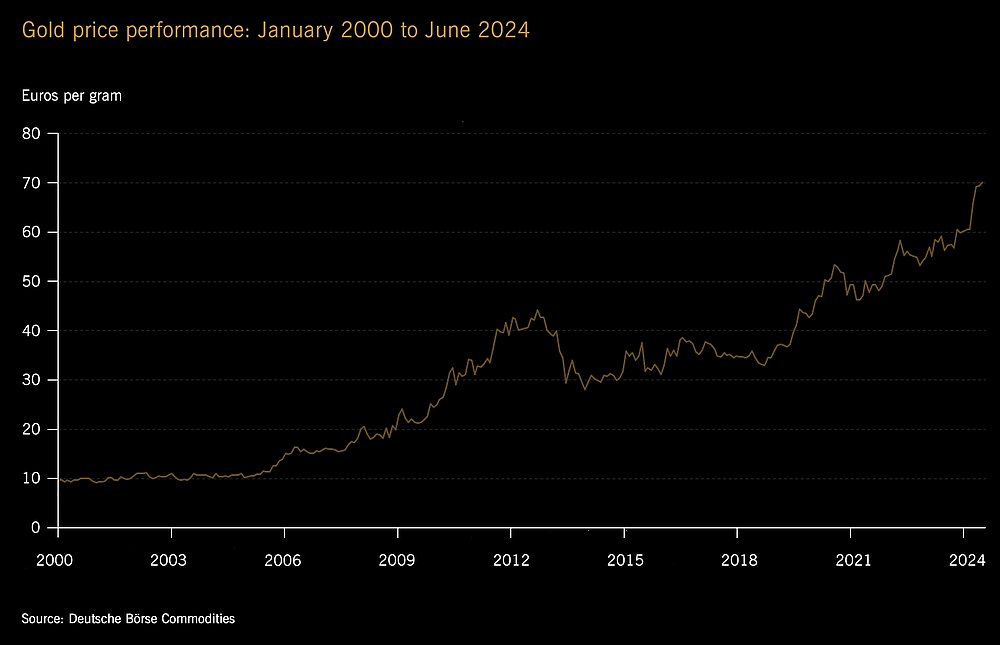

Among the notable characteristics of gold is its dual function: the precious metal is a scarce commodity as well as an investment. The development of gold demand and thus its price depend on a considerably higher number of factors than that of stocks. Although the gold price development in recent years has been predominantly positive, it is therefore also subject to frequent fluctuation. Major influences on the gold price can be subdivided into long-term, medium-term and short-term factors. Among the more long-term influences is economic growth, both within individual countries as well as globally. By contrast, geopolitical crises and massive strategic gold buying or selling activity by major futures markets investors only have a short-term influence on the gold price.

Gold demand increases alongside prosperity

The long-term gold price development is heavily dependent upon that of a country or region’s wealth and economic growth. This is due to the fact that economic boom phases affect gold demand, i.e. demand for coins, bullions or gold-backed securities, favourably. Gold is acquired in larger quantities only above a certain income level, and this is true both for gold as an investment as well as for precious gold jewellery. Luxury goods are bought only by those who can afford them, as evident in the development of private demand for gold in China, which has seen an exponential rise in recent years.

Central banks rely on gold as a currency reserve

According to the World Gold Council, central banks across the world have continuously expanded their gold holdings in recent years, thus supporting the gold price. Around 34,789 tonnes of gold are now stored in central bank vaults, 10,776 tonnes of which are held by eurozone central banks alone (including the ECB), where gold accounts for 59 per cent of total currency reserves. Any change in this long-term strategy among central banks could result in gold sales flooding the market, which would have a dampening effect on the price of the precious metal.

Industrial applications impact gold price development

While roughly half of the gold sold worldwide is in the form of jewellery, there are many other, industrial applications for the precious metal. According to a study conducted at Chalmers University of Technology in Gothenburg, Sweden, cars across Europe contain some 440 tonnes of gold in automobile components.

The chemical industry heavily relies on gold as a catalyst, and it is growing increasingly important in the medical field. As a vital component of rapid tests for the detection of a number of diseases such as malaria, it is currently also used in most COVID-19 detection tests. Gold is also employed to treat joint diseases such as rheumatism.

Moreover, due to its extreme ductility and conductivity, the precious metal is an indispensable component of many mobile applications such as smart phones and smart wearables. This is an area where strong growth rates are expected in the future – a development likely to support the price of gold.

Long-term gold price development not only controlled by demand

Gold is a rare commodity that is expensive to mine and therefore precious. No significant new gold deposits have been discovered worldwide since 2012, and according to the financial information service provider SNL, today’s known production opportunities could be exhausted within twelve years if the sustained high global demand for gold continues. For the past ten years, it has stood at above 4,000 tonnes a year.

According to a study by precious metals consultancy Metals Focus, the mining price per troy ounce of gold in an existing gold mine amounts to US$1,150. The price tag is far higher if a mining company has to develop previously unused gold deposits and build new production facilities, which can take up to 15 years, and the so-called incentive price per troy ounce is then US$1,500. For mining companies, the development of new gold deposits is simply not worth their while if the gold price falls below this threshold. The total amount of mined gold is therefore important for the price development of the precious metal. Major gold producers’ annual balance sheets, published in the Investor Relations section of their respective websites, provide production quantity information as well as facts about gold recycling activities, a topic increasingly relevant among gold producers. According to the trade journal “EU-Recycling and Environmental Technology”, 30 per cent of global global demand is already met through recycled gold.

High inflation may boost gold price in the medium term

History has shown time and again that in times of high inflation rates, such as the 1970s in the US, the gold price tends to see a sharp increase. As part of the annual 2018 survey conducted among central banks, which examined motivational factors in the expansion of their gold holdings, 55 per cent cited the precious metal’s function as a protection against inflation. However, the gold price is likely to benefit little when inflation rates are more moderate, and when inflation-indexed government bonds are an attractive interest-bearing alternative.

Interest rate levels have major impact on gold price

Gold has always been considered the hardest currency in the world; the precious metal is not subject to age or decay, and contrary to a number of securities, it does not bear any default risk. It does, however, share another characteristic with currencies: it does not offer any return by way of interest or dividends. Its value increases only through its price. In this, gold is at a disadvantage compared with shares, bonds and other securities, as well as investment products such as money market accounts or savings plans. The gold price is sensitive to interest rate movements, which are generally triggered by medium-term changes in individual countries’ key interest rates, i.e. by the ECB within the eurozone. If real interest rates (interest rates adjusted for inflation) rise, the impact on the price of gold can be negative, as other investment opportunities become more attractive. Conversely, the price of gold benefits from low real interest rates, which are now common across a number of countries. For years, both the US and the eurozone have been pursuing a strict low or zero interest rate policy.

However, interest rate movements do not always impact the gold price in the same way. As the World Gold Council has found in a US study, it is the direction that matters. While in times of negative US real interest rates the gold price per troy ounce tended to develop twice as well as the long-term average, it remained positive alongside positive real interest rates up to a level of 2.5 per cent. Only when real interest rates rose above this level did the gold price weaken.

US dollar most influential currency in gold price development

Like most commodities, gold is traded on the world market mainly against the US dollar in terms of volume. Both the US dollar and gold are sought-after foreign currency reserves for central banks around the world. It is no coincidence that the US Federal Reserve has the by far largest gold reserves, and in the days of the gold standard, the price of gold and the US currency were linked. Today, the US dollar and gold price give reciprocal short-term impulses. A strong dollar tends to weaken the gold price, while a strong gold price usually has a dampening effect on the US currency. A weak dollar, in turn, can cause the gold price to rise. However, this does not apply in both directions to the same extent, as evident in an analysis by the World Gold Council in 2018, which is based on the long-term evaluation of monthly gold data from January 1971 to March 2018. In times of a weak US dollar, the gold price tends to rise twice as strongly as it recedes against a rising dollar. This asymmetrical relationship is also apparent in the precious metal’s price development in relation to other currencies. During the European financial crisis, gold price performance was strikingly similar to that of the euro. Many professional investors therefore use gold to hedge against possible weakness of the US dollar, euro and other currencies.

Stock market developments can impact gold price

Stock indices such as the DAX® or the EURO STOXX 50® reflect the economic performance of a country or region: in times of economic highs, indices are up, during economic crises, they drop. These developments are usually medium-term and may drive the price of gold, but not necessarily. Although flourishing companies’ stocks tend to offer attractive alternatives to gold investments, a boom also entails a growth in prosperity, which, as mentioned above, is often echoed in a rising demand for gold. Concerns about future crises not yet reflected in the performance of a stock index can also lead to increasing gold investments, despite the boom. From the end of 2018 to the beginning of 2020, this occurred in both the eurozone and the US, when gold saw a rally despite highs in stock indices.

The impact of geopolitical uncertainties

In our globalised society, crises are hardly ever limited to one particular region with no impact on the rest of the world. Both the smouldering US-Chinese trade conflict and Brexit are prime examples, as both have had a lasting impact on the gold price. Similarly, regionally limited threats or wars can cause investors around the world to seek refuge in safe haven investments, as was the case in 1980, when the gold price reached a new record high following the Soviet Union’s invasion of Afghanistan.

Major gold investors’ moves carry weight

A look at swarm intelligence or investment professionals’ activities – both can be helpful in assessing the gold price’s potential development, which is where inventory data of so-called gold ETCs comes in.

An ETC is an exchange-traded commodity fund open to investor participation. Since the units are usually certificates or debentures that would not protect investors from total loss in the event of the fund issuer’s insolvency, a number of the funds are physically backed with the commodity. For every unit sold in a gold ETC, a corresponding amount of real gold is deposited, which can mean large quantities of gold coming together. The holdings of Xetra-Gold, Europe’s most widely traded physically backed ETC, comprise more than 200 tonnes of bullions. Gold ETC inventory changes, published daily by news agencies such as Reuters or Bloomberg, provide insight into the current demand situation for gold and allow investors to identify trends.

In view of diverse influencing factors, a forecast is difficult

If it were possible to observe the gold price under laboratory conditions in combination with just one of the influencing factors mentioned above, a reasonably reliable development forecast might be possible. The reality of the situation is much more complex. Long- and medium-term factors interact, and their effect can be weakened or even levelled out suddenly by unforeseen occurrences. Events that have nothing to do with the gold market may exert great influence, as seen most recently when the COVID-19 pandemic escalated into a global crisis. As expected, we saw significant slumps across the stock markets, while the safe haven gold gained significant value. The following price decline came as suddenly as it was unexpected – in all experience, the simultaneous base rate cut in the US should have served as additional stimulus for gold demand. So what happened? Have commodity experts and analysts across the globe been getting it wrong all these years? They have not; these most recent developments were due to major investors’ liquidations of extensive gold holdings on the futures market in an effort to meet their payment obligations resulting from stock market losses.

We have seen that the individual factors influencing the gold price should all be taken into account and evaluated within the context of developments in other markets. Only by taking in this greater picture can we arrive at a certain idea of where the precious metal might be headed in the near future. And, as is true for all types of investment, there is no such thing as a reliable forecast.

Picture: © PantherMedia / SerendipityDiamonds

Interesting articles about gold

Interesting articles about gold

Xetra-Gold Hotline

Do you have questions? We have the answers. Contact us here: 9 a.m.–6 p.m. CET

xetra-gold(at)deutsche-boerse.com

For press inquiries: media-relations(at)deutsche-boerse.com