Investing in gold: how to find the right product for every type of investor

Gold facts & figures Arnulf Hinkel – 17.06.2020

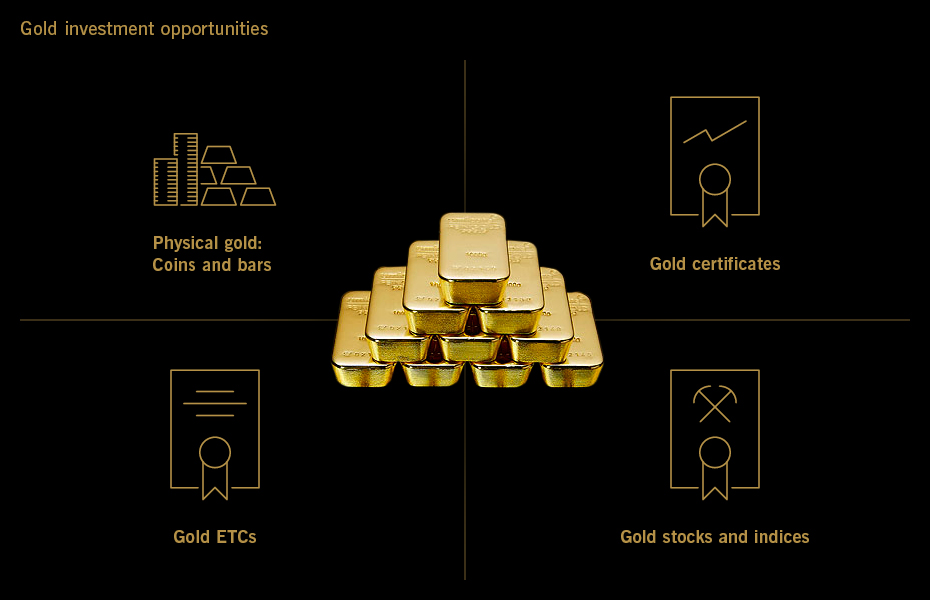

Since the Lydian king Croesus introduced standardised gold coins as currency around 560 BC, the precious metal has established itself as the world’s hardest currency. In India and China, over 60 per cent of private investors place a high degree of trust in gold, a significantly higher percentage than those who say the same about their national currency. Gold remains a popular store of value and investment item, especially in times of crisis, as its performance is largely independent of major capital markets. According to a 2019 study by management consultant Mercer Germany, an admixture of up to 5 per cent of gold in a portfolio can therefore be a sensible diversification. It can help to stabilise price fluctuations on the markets, compared to a pure stock/bond portfolio. While in ancient times the precious metal was traded and stored in the form of bars or coins, a much wider range of investment opportunities is available today. In addition to physical gold, investors can choose among various securities, some of them backed by physical gold and reflecting the performance of the precious metal. See below for the opportunities and specific advantages of the various investment products, as well as their suitability for certain types of investors.

Physical gold: advantages and disadvantages of coins and bars

Many investors swear by physical gold, which is easily accessible and can be monetised at any time, in times of crisis or for liquidity. In Germany, gold up to an amount of €15,000 can be purchased anonymously, which can have advantages. Before purchasing physical gold, most commonly in coins or bars, there are a number of issues to be considered. Novices should limit their choice to products and manufacturers recognised worldwide, such as Vienna Philharmonic, American Gold Eagle, Maple Leaf coins or Krugerrand. With regard to gold bars, investors should trust manufacturers certified by the London Bullion Market (LBMA), such as Umicore, Degussa or Heraeus.

Top priority for gold purchases: price comparison

The spreads, i.e. the margins between the buy and sell price, of gold coins and bars can be enormous, especially when it comes to small gold bars, which in production are disproportionately expensive in relation to their actual physical value. A price comparison with banks and renowned gold dealers is therefore vital. It is important to exclude any unfamiliar or dubious dealers or online merchants with suspiciously cheap offers. The same of course applies for selling.

The spreads, i.e. the margins between the buy and sell price, of gold coins and bars can be enormous, especially when it comes to small gold bars, which in production are disproportionately expensive in relation to their actual physical value. A price comparison with banks and renowned gold dealers is therefore vital. It is important to exclude any unfamiliar or dubious dealers or online merchants with suspiciously cheap offers. The same of course applies for selling.

As a rule, the larger the gold bar to be purchased or sold, the smaller the price range. Investors need to decide how large or small the denomination of the gold investment should be; lower acquisition costs for larger gold bars are offset by less flexibility in the desired sales quantity.

Further costs after acquisition

After the purchase comes the question of safe storage. In Germany, investors often rent a safe deposit box, which entails additional annual costs in the low double-digit euro range. As the contents of bank vaults are not usually automatically insured against theft, special attention should be paid to the question of whether appropriate insurance is included or offered as a supplement. Liability limits of the insurance offered should also be taken into account.

However, in some cases, the contents of safe-deposit boxes are covered by a household insurance policy, the details of which are listed in the insurance contract, usually as “external insurance”.

Significantly fewer gold owners decide to store their bars or coins in their own homes as this involves considerable additional safekeeping costs and insurance coverage beyond standard homeowners’ insurance.

Conclusion: maximum flexibility comes at a price

Physical gold is directly accessible and can serve as a liquidity reserve outside the financial system at all times, which can be an important advantage in times of extreme crisis or in certain emerging markets. However, the higher buying and selling price spreads and ongoing storage costs of physical gold compared to other forms of gold investment also mean a reduced return on investment, which can only be achieved via price increases. For investors who see gold primarily as an investment and want to benefit from its stabilising effect, there are more favourable alternatives.

Gold stocks and indices: advantages and disadvantages of indirect investment

Gold indices such as the NYSE Arca Gold Bugs Index are composed of gold shares of large gold-producing mining companies and as such do not offer a direct investment in gold. In phases of rising gold prices, both profits and production reserves of mining companies increase, in turn raising leverage of the gold stocks’ performance by a factor of two to three compared to the gold price – hence their popularity. This is true at least in theory. In practice, gold mining stocks usually perform weaker than gold itself, as is evident in a comparison of the gold price with the NYSE Arca Gold Bugs Index over a 20-year period. This is due to the ever increasing extraction costs of the rare precious metal and the various uncertainties the mining business is exposed to. In addition to geopolitical risks – many gold deposits are located in emerging markets – problems specific to the mining industry, such as water ingress, adit collapse or a lower-than-expected exploitation rate can significantly reduce a mining company’s profit. Volatility is therefore higher for gold stocks than for the precious metal itself.

Comparison of gold price with the Nyse Arca Gold Bug Index since January 2011

Source: Guidance / Yellow Value: Gold Price ; Purple Value: Nyse Arca Gold Bug Index

Conclusion: a rather short-term investment for risk takers

With gold shares, the higher yield opportunities compared to physical gold due to the leverage effect are also offset by a much higher investment risk. An investment in the shares of gold-producing companies is best made via corresponding ETFs (exchange-traded funds), which bundle the performance of many large mining companies, thereby spreading the investment more widely and reducing risk. The brave can profit from short-term commitments during a gold boom, but the investment is unsuitable for portfolio stabilisation.

Advantages and disadvantages of gold ETCs

Since the legal framework provided by the UCITS guidelines does not allow ETFs with only a single component to be offered within the EU, ETCs (exchange-traded commodities) have taken over this role in Europe. ETCs enable investors to directly participate in the gold price development without having to actually own physical gold. The advantage: as explained above, owning physical gold entails ongoing safekeeping costs, which reduce returns, as do high buy or sell spreads. Gold ETC transactions, on the other hand, are just as flexible as those of shares or ETFs, thus incurring minimal transaction costs. Some products, such as Xetra-Gold, which is the most widely traded ETC in Europe, even grant the investor the right to delivery of physical gold in the amount of the respective ETC investment. For a fee, investors can exchange their Xetra-Gold bearer bonds for the securitised amount of physical gold, as Xetra-Gold, like many other gold ETCs, is physically backed. For each ETC unit, the issuer holds a corresponding amount of gold in custody. This security deposit outweighs an otherwise decisive disadvantage of gold ETCs; from a purely legal point of view, ETCs are debt securities, which in the extreme case of an issuer’s bankruptcy can cause a total loss of the investment. Collateralisation with physical gold greatly reduces this risk.

Since the legal framework provided by the UCITS guidelines does not allow ETFs with only a single component to be offered within the EU, ETCs (exchange-traded commodities) have taken over this role in Europe. ETCs enable investors to directly participate in the gold price development without having to actually own physical gold. The advantage: as explained above, owning physical gold entails ongoing safekeeping costs, which reduce returns, as do high buy or sell spreads. Gold ETC transactions, on the other hand, are just as flexible as those of shares or ETFs, thus incurring minimal transaction costs. Some products, such as Xetra-Gold, which is the most widely traded ETC in Europe, even grant the investor the right to delivery of physical gold in the amount of the respective ETC investment. For a fee, investors can exchange their Xetra-Gold bearer bonds for the securitised amount of physical gold, as Xetra-Gold, like many other gold ETCs, is physically backed. For each ETC unit, the issuer holds a corresponding amount of gold in custody. This security deposit outweighs an otherwise decisive disadvantage of gold ETCs; from a purely legal point of view, ETCs are debt securities, which in the extreme case of an issuer’s bankruptcy can cause a total loss of the investment. Collateralisation with physical gold greatly reduces this risk.

Conclusion: long-term and cost-efficient gold market participation

Of all non-physical investment opportunities in gold, ETCs are closest to the real thing, especially if the product includes the option of delivery of physical gold. However, exchange-traded investment products cannot be traded discreetly and anonymously, as physical gold can.

Cheapest form of investment: advantages and disadvantages of gold certificates

Legally speaking, certificates such as ETCs are debt securities. However, gold certificates generally refrain from any form of hedging, which makes them rather risky, unsuitable for long-term investments. On the other hand, trading in gold certificates is generally cheaper than trading in collateralised ETCs. In addition to the standard versions of gold certificates – mostly index certificates – there are alternatives such as bonus or discount certificates, which allow investors to reduce their costs or investment risk somewhat by precisely limiting their return opportunities.

Conclusion: short-term speculation with high investment risk

Gold certificates are ideal for investors willing to take risks and seeking short-term profit from price fluctuations in the gold market, but are uninterested in gold functioning as a portfolio stabiliser. The asset class is therefore not suitable for those seeking to protect their assets in times of crisis.

Tax advantages of gold not for every form of investment

After a minimum holding period of one year, gains from the sale of gold are not subject to withholding tax, which normally applies to investment income in Germany. As a result, the capital gains are exempt from any tax, because for tax purposes, gold coins and bars are considered physical valuables, such as jewellery or fine whiskey. This rule also applies to some ETCs, such as Xetra-Gold, as the bonds are backed by physical gold. In 2017, the German Federal Fiscal Court decided that, after a holding period of at least one year, the same exemption from withholding tax is applicable to gains from the sale of Xetra-Gold shares as to that of physical gold. Gold shares, ETFs on indices of gold-producing companies and gold certificates do not benefit from this rule.

After a minimum holding period of one year, gains from the sale of gold are not subject to withholding tax, which normally applies to investment income in Germany. As a result, the capital gains are exempt from any tax, because for tax purposes, gold coins and bars are considered physical valuables, such as jewellery or fine whiskey. This rule also applies to some ETCs, such as Xetra-Gold, as the bonds are backed by physical gold. In 2017, the German Federal Fiscal Court decided that, after a holding period of at least one year, the same exemption from withholding tax is applicable to gains from the sale of Xetra-Gold shares as to that of physical gold. Gold shares, ETFs on indices of gold-producing companies and gold certificates do not benefit from this rule.

Matching up type of investment with type of investor

Essential for the decision which of the presented investment forms is the most suitable is the question whether and to what degree gold is sought to increase portfolio stability and act as a safe haven in times of crisis and inflation protection. Security-oriented, long-term investors will certainly chose physical gold or gold-backed ETCs. Among the two, the choice will ultimately depend on personal preference, as well as the question of whether the investor is willing to forego part of the possible return in favour of physical ownership of gold.

Venturesome investors will be more likely to choose gold certificates and thereby speculate on short-term price movements in the volatile gold market or invest in gold shares of mining companies, which are even more volatile in their performance. Both forms of investment bear significantly higher risks of loss and none of the precious metal’s traditional primary function as a hard currency with some degree of crisis protection.

Xetra-Gold Hotline

Do you have questions? We have the answers. Contact us here: 9 a.m.–6 p.m. CET

xetra-gold(at)deutsche-boerse.com

For press inquiries: media-relations(at)deutsche-boerse.com